HDFC Bank, a major player in the Indian banking sector, has seen its share price fluctuate recently. Understanding the reasons behind these movements requires analyzing various factors, including financial performance, market trends, and broader economic conditions. This article delves into the potential causes for a decline in HDFC Bank’s share price on a given day.

Potential Reasons for HDFC Bank Share Price Decline

Several factors can contribute to a drop in HDFC Bank’s share price:

1. Quarterly Earnings and Financial Performance:

- Lower than expected profits: A decline in net profit or a significant deviation from analyst estimates can trigger a negative market reaction. HDFC Bank’s Q3 FY24 results showed a 7.63% decrease in consolidated total income compared to the previous quarter, which could concern investors.

- Rising Non-Performing Assets (NPAs): An increase in bad loans can impact profitability and raise concerns about asset quality, potentially leading to a share price drop. However, as of December 31, 2024, HDFC Bank reported standalone gross NPAs and net NPAs at 0.00% of total assets.

- Decreased loan growth: A slowdown in loan disbursement can indicate weakening demand and impact the bank’s revenue growth, affecting investor sentiment.

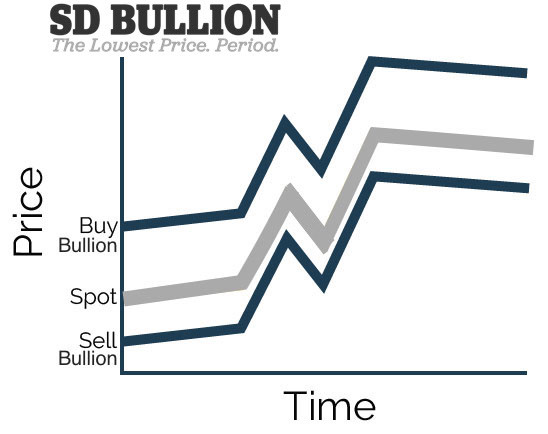

Alt: A chart illustrating HDFC Bank’s financial performance, including key metrics like net profit and loan growth.

2. Broader Market Trends and Economic Conditions:

- Negative market sentiment: A bearish overall market trend can impact even well-performing stocks like HDFC Bank.

- Changes in interest rates: Fluctuations in interest rates can affect the banking sector’s profitability and influence investor decisions.

- Economic slowdown: Concerns about a potential economic recession or slowdown can lead to a sell-off in bank stocks, including HDFC Bank.

- Regulatory changes: New regulations or government policies impacting the banking sector can create uncertainty and affect share prices.

Alt: A graph depicting the trend of the Indian stock market, indicating overall market sentiment.

3. Company-Specific Factors:

- Management changes: Significant changes in leadership can sometimes lead to uncertainty and impact investor confidence.

- Mergers and acquisitions: Large-scale mergers or acquisitions can create short-term volatility in share prices as the market assesses the deal’s implications. While the HDFC-HDFC Bank merger is complete, integration challenges could influence investor perception.

- Analyst downgrades: Negative ratings or price target revisions by analysts can influence investor decisions and lead to selling pressure. The article mentions a median target price of Rs. 1987.15, but also a low estimate of Rs. 1627.0, suggesting potential downside.

- Increased competition: Intensified competition from other banks or fintech companies can impact HDFC Bank’s market share and profitability. The article highlights peer comparisons with ICICI Bank, Kotak Bank, Axis Bank, and IndusInd Bank.

Conclusion

HDFC Bank share price fluctuations are influenced by a complex interplay of factors. While the bank boasts strong fundamentals, short-term volatility can arise from various internal and external factors. Investors should consider these factors and conduct thorough research before making investment decisions. Monitoring quarterly results, industry trends, and macroeconomic indicators can provide valuable insights into HDFC Bank’s future performance.