Empire Today Llc, also known as Empire Carpet and Empire Flooring, a leading direct-to-consumer flooring company in the United States, has secured a new credit facility with existing lenders. This agreement will provide Empire Today LLC with increased liquidity and extend its debt maturities, enhancing its financial flexibility. The new credit facility extends the maturity of Empire Today LLC’s revolving credit facility to February 2029 and approximately 82% of its term loan to August 2029. The remaining 18% of the term loan has the option to extend to August 2029 under a separate offer. Importantly, the agreement waives Empire Today LLC’s revolving financial covenant for the next two years and eliminates other financial covenants during this period.

This transaction provides Empire Today LLC with essential liquidity and financial flexibility to navigate the current economic landscape. The company has also implemented operational streamlining and strengthened its management team in recent years, positioning it for growth as the flooring industry recovers. Empire Today LLC expresses gratitude for the ongoing partnership with Charlesbank and H.I.G. Capital and aims to solidify its financial foundation to execute its future strategy effectively. Ropes & Gray LLP and Greenhill & Co., LLC are acting as legal and financial advisors to Empire Today LLC. Paul Hastings LLP and Lazard are advising an ad hoc group of consenting first lien lenders.

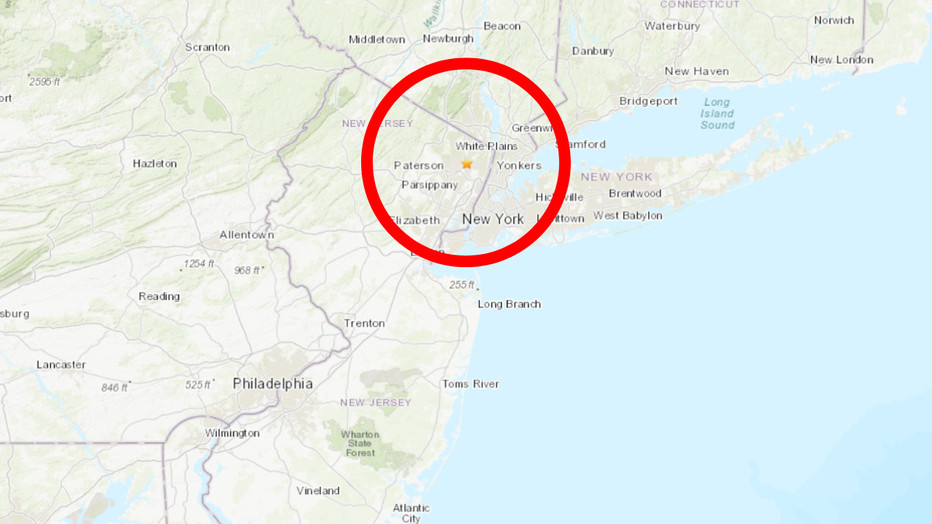

Empire Today LLC, recognized for its direct-to-consumer sales approach and iconic jingle, has provided installed home improvements and furnishings for 65 years. Serving residential and business customers, Empire Today LLC offers a broad range of products including carpet, hardwood, laminate, tile, and vinyl flooring. The company provides shop-at-home convenience, next-day installation on select products, competitive pricing, and award-winning service in over 70 major metropolitan areas across the United States. With a history of satisfied customers, Empire Today LLC prioritizes customer satisfaction.

Charlesbank Capital Partners, a middle-market private investment firm with substantial assets under management, focuses on management-led buyouts, growth capital, opportunistic credit, and technology investments. The firm targets companies with strong competitive advantages and growth potential.

H.I.G. Capital, a global alternative investment firm with a diverse portfolio, provides debt and equity capital to middle-market companies. Specializing in management buyouts, recapitalizations, and corporate carve-outs, H.I.G. employs a flexible and operationally focused approach. H.I.G.’s debt funds offer various financing options to companies of all sizes, both directly and in secondary markets. Additionally, H.I.G. manages real estate funds focused on value-added properties and infrastructure funds targeting value-add and core plus investments.

Since its inception, H.I.G. has invested in and managed numerous companies globally. With a current portfolio encompassing a wide range of businesses, H.I.G. has a significant impact on the middle market.