As tax time approaches, the IRS is automatically sending payments to around a million taxpayers who didn’t claim the 2021 Recovery Rebate Credit. This has sparked considerable interest in “IRS automatic stimulus payments” and eligibility criteria. These payments, up to $1,400 per person, aren’t tax refunds but unclaimed Recovery Rebate Credits from 2021 tax returns. The IRS aims to simplify the process, ensuring eligible individuals receive these funds without filing amended returns.

The IRS has allocated roughly $2.4 billion for these automatic payments. Eligible individuals can receive up to $1,400, while married couples can receive up to $2,800. A family of four with two qualifying dependents could receive a maximum of $5,600. The actual payment amount depends on adjusted gross income (AGI). The full credit is available for individuals with AGIs up to $75,000 and married couples filing jointly with AGIs up to $150,000. The credit amount gradually decreases for higher incomes, reaching zero for individuals with AGIs of $80,000 or more and married couples with AGIs of $160,000 or more.

Eligible recipients don’t need to do anything to receive the payment. The IRS will direct deposit the funds into the bank account provided on the 2023 tax return or mail a cheque to the address on file. The IRS will also send a separate letter confirming the payment. Payments are expected to arrive by late January.

Those who believe they’re eligible but haven’t received an automatic payment can still claim the Recovery Rebate Credit by filing a 2021 tax return. The deadline for filing is April 15th. This applies even if income was minimal or non-existent in 2021.

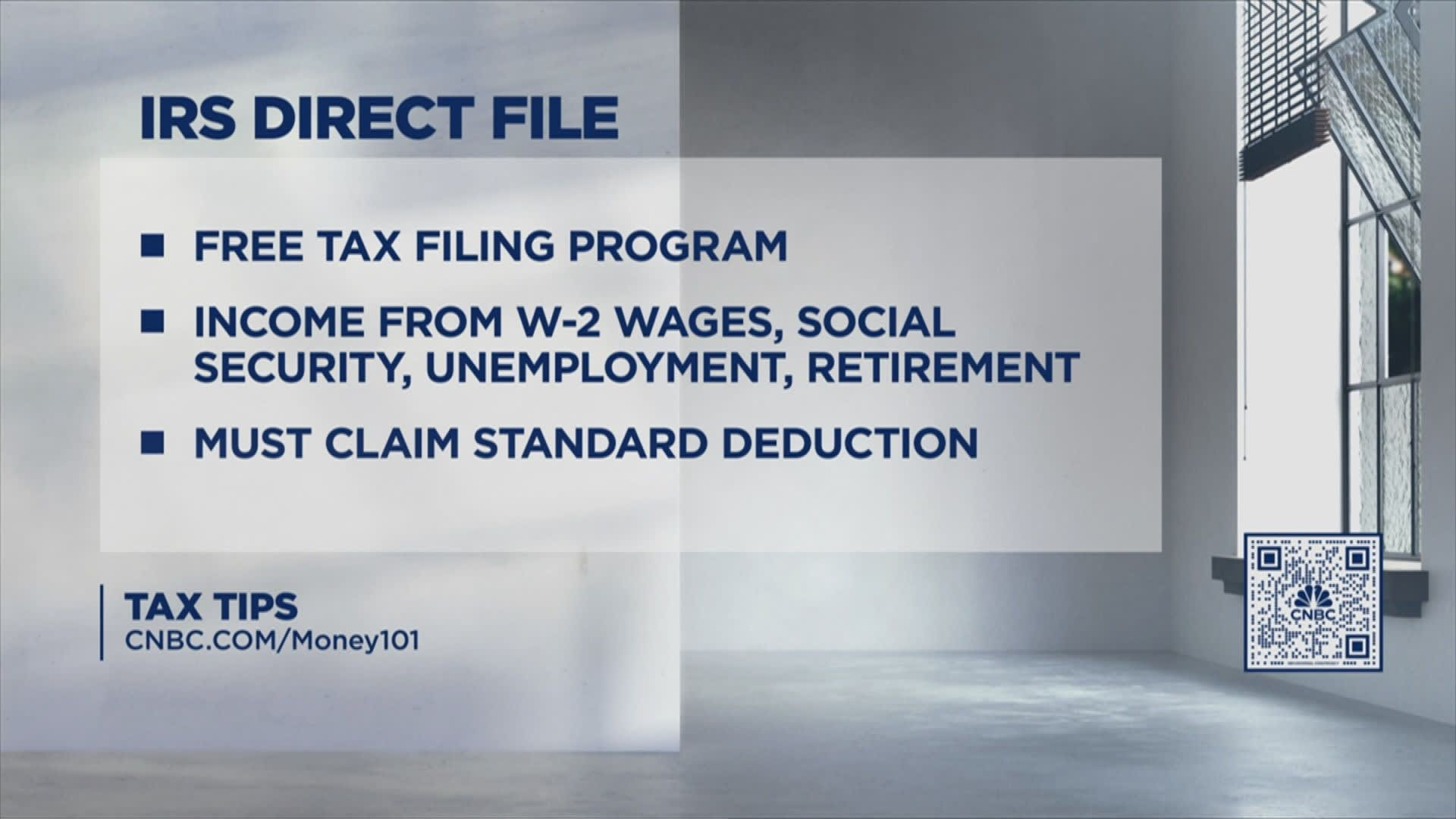

IRS Free Filing Options

IRS Free Filing Options

The stimulus cheques distributed in 2020 and 2021, along with increased unemployment benefits and child tax credits, coincided with a significant rise in inflation. This has led to debate about whether these stimulus efforts contributed to the inflation surge. Treasury Secretary Janet Yellen acknowledged that the spending might have played a small role but emphasized that inflation was primarily driven by supply-side issues, such as supply chain disruptions and increased demand for goods. Recent government data indicates a slowdown in core inflation, excluding food and energy prices. However, the Federal Reserve continues its efforts to achieve its 2% inflation target.